Build your options learn-how with the movies, immediateedgereview.com articles, and you can expertise. Strangles have a tendency to typically end up being less expensive than straddles because the possibilities ordered is actually OTM choices. These are provided for membership control and standard financial aim. Make a lot of time-name wealth utilizing the Motley Fool’s business-beating method. Those familiar with the fresh Greek alphabet have a tendency to say that there’s not any Greek page titled vega.

- The dangers from loss out of investing CFDs will be ample plus the value of the assets could possibly get vary.

- As opposed to calling its cash per change “commissions,” many options brokers costs per-bargain charge (as well as certain agents whom claim to features “no payment” choices trade).

- This permits you to make the most of extreme rates motions in a choice of assistance while you are restricting potential losings to your premiums paid back.

- To possess a portion of the cost, you efficiently handle one hundred offers (otherwise whatever the bargain stipulates).

- In such a case, the new investor could make money away from $dos.twenty five for each share ($46 strike price – $43.75 cost basis).

Place choices are assets where consumer thinks the root stock’s market price have a tendency to fall underneath the strike rate on the otherwise before the fresh termination date of your own solution. Once again, the newest proprietor can sell offers without the obligation to market in the the new mentioned strike per share rate by the said go out. If your prevailing market share price is in the or below the strike speed because of the expiration, the option expires worthlessly on the label consumer. The option isn’t worked out as the buyer won’t find the stock in the struck speed greater than or equal to the prevailing market value.

Safeguarded phone calls:

A long straddle method concerns to purchase a trip and set alternative for the same advantage with the same strike rate and termination go out meanwhile. You can utilize this approach whenever an investor try being unsure of and that method costs for the underlying advantage will probably circulate. Ever wondered exactly how competent buyers profit if locations go up or down?

Promoting Label Possibilities

If you purchase a visit choice, you have the directly to purchase 100 shares of one’s given protection. If you buy an utilized choice, you have made the legal right to sell one hundred shares of the stock. When you are looking and in case more exposure to boost forget the productivity, up coming exchange possibilities would be practical. Stock options is contracts giving the master the right — although not one responsibility — to buy or offer an inventory during the a certain price from the a specific date. The author (otherwise supplier) may either retain the newest offers and you may hope the fresh stock rates increases right back above the price or sell the newest shares or take the loss.

Getting started off with Options Exchange

An extended place comes to to purchase a put choice that have an attack price lower than the underlying resource’s most recent rates, in which case the newest place was OTM. Traders make use of this means when they expect a-sharp miss within the prices. Much time calls involve to purchase a call solution having a higher struck price compared to root asset’s latest rates, definition the option has gone out-of-the-money (OTM). Investors utilize this means once they predict cost to rise notably.

While using the protected phone calls, the new buyer produces the brand new superior and may be required to submit the fresh offers if the consumer of your own call decides to do it the options. It’s right for investors which believe that the expense of the new inventory often disperse around sideways to your life of the brand new possibilities package. With regards to spending, you are not limited to simply buying and selling possessions such brings and you can securities personally. Harder ties labeled as possibilities in addition to can be found, which provide people the best — but not a duty — to help you trading an underlying advantage in the a selected rate because of the a given timeframe. It requires attempting to sell phone call options facing a stock position your currently own. Such, if you own one hundred shares away from Fruit at the $118, you can offer a good December $120 phone call option for $700.

When you’re ready first off choices trade, like a brokerage that provides reduced per-bargain payment to own alternatives, as well as research and you may devices that will help book just what steps you choose along the way. Possibilities change is known to be somewhat high-risk, simply due to how cutting-edge it can be to learn. Because of this it’s very important one to investors recognize how options performs before getting in it. Paying your bank account within the something that you don’t understand is not a great smart financial flow. A western inventory solution might be worked out any moment ahead of the brand new termination day, when you are Eu alternatives can only be worked out for the termination day.

An identical layout laws and regulations (American or Eu) use if you can get it done him or her. All opportunities try at the mercy of danger of losings, that you should consider to make any financing behavior. Audiences from Trading To your Professionals applications is to talk to the monetary advisors, attorney, accounting firms or other accredited pros prior to making people money choice. Consumers from TWP applications is to consult with its economic advisors, attorneys, accountants or other certified advantages before you make people money choice. TWP can make no make certain otherwise vow of any kind, express otherwise designed, you to someone usually cash in on otherwise avoid losings by using guidance disseminated due to TWP.

Spreads are created having fun with vanilla extract choices and certainly will benefit from individuals conditions, such as high- or reduced-volatility surroundings, up- or off-actions, otherwise one thing within the-between. An extended label are often used to speculate to your price of one’s fundamental rising, because it has endless upside prospective but the restriction loss is the newest premium (price) paid for the option. For this reason, a defensive lay are a lengthy lay, like the approach we talked about above; however, the mark, because the label indicates, is actually drawback protection as opposed to attempting to cash in on a drawback circulate. In the event the a trader has shares with an optimistic sentiment in the longer term however, desires to avoid a fall from the short run, they may pick a protective set.

A lengthy straddle can only eliminate a total of everything taken care of it. Since it relates to a couple possibilities, although not, you will be charged more either a trip otherwise lay by the by itself. The possibility losings away from a lengthy phone call is restricted to the superior paid. Possible funds try unlimited because the solution incentives increase that have the underlying investment rates up until expiration, and there is theoretically zero limit to help you exactly how high it will wade.

On the bright side, should your stock’s rate increases, you’ll be your advanced, as well as one percentage. Centered on the newest fundamentals of our attempted-and-tested exchange procedures, all of our proprietary signs to have TradingView will provide you with the new believe so you can make better-informed trading conclusion. A publication built for field followers by the business lovers.

Prevent Losses Requests

He or she is functionally just like most other indexed possibilities, but having lengthened times up to termination. Options you to end out from the currency is actually worthless without dollars transform hands during the expiration. Possibilities exchange is a sophisticated approach frequently employed by excellent investors. Buying and selling choices productively needs lots of search as well as in-breadth comprehension of your stock ranks.

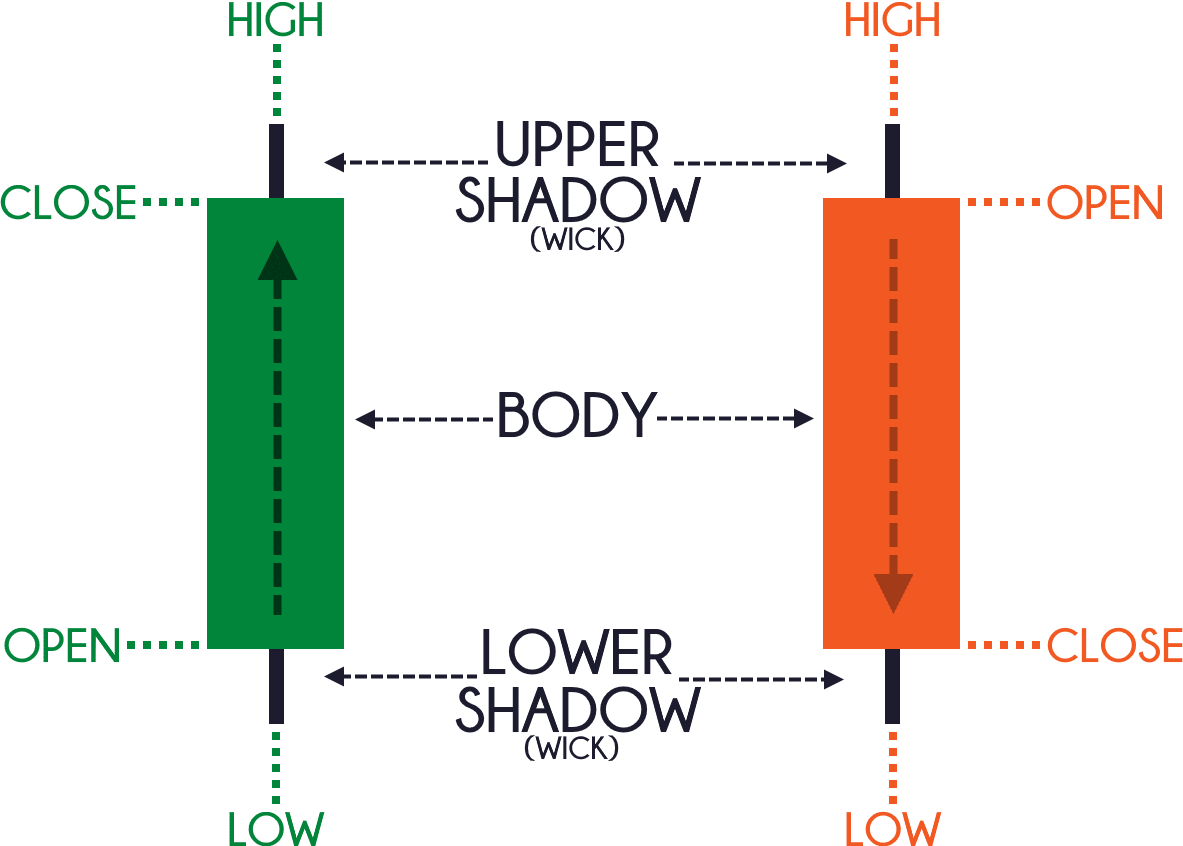

A call option provides you with the ability to pick an underlying resource inside a specific months, if you are a made use of option offers the authority to promote a keen advantage inside an occasion. Instead of possessing the genuine stock, you have the right to buy otherwise sell at the an decided price to your a specific date. To find a made use of alternative will provide you with the best, however the duty, to sell a market during the strike rates on the otherwise prior to a set date. Once you learn the basics of how options works, getting possibilities trading actions in position marks the next phase.