Brokers provide 100 percent free costs designs, meaning they won’t cost you to own carrying out positions otherwise provides repaired earnings. When you are 100 percent free rates may sound advantageous to have buyers because takes away initial will cost you, there are charge for trading. In some cases, particular brokers tend to be expensive to change for the because of the brand new bequeath. Therefore, you have to know the develops on the hidden possessions your’lso are trying to find change. They enable it to be investors to speculate to the rate movements away from personal enterprises instead of having shares. Whenever change holds inside CFDs, investors can access a variety of businesses away from some other sectors and markets, of technical beasts such as Apple in order to blue-processor companies for example Coca-Cola.

What locations must i exchange to the?

Exchange for the margin CFDs generally provides higher leverage than just antique exchange. Simple power on the CFD industry definitymaintenance.com is as low because the an excellent 10% margin requirements so when large as the an excellent fifty% margin but it can differ rather by agent. Straight down margin conditions cause reduced funding outlays and you will potentially highest productivity. CFDs are generally utilized by buyers and make price bets because the to help you whether the cost of the root advantage or security often rise or fall. EToro tends to make zero image and you may takes on no responsibility as to what accuracy or completeness of your blogs of the publication.

Please keep me updated to your Trading Country’s sponsorships, information, events and provides. Let’s consider a few of the certain advantages provided due to change CFDs. Here are a few the classes to the margin within our Margin 101 course you to definitely vacations it the complete nice and lightly for you. Forex CFDs enables you to change for the energy (or tiredness) of one money instead of various other.

Benefits and drawbacks from CFD trading

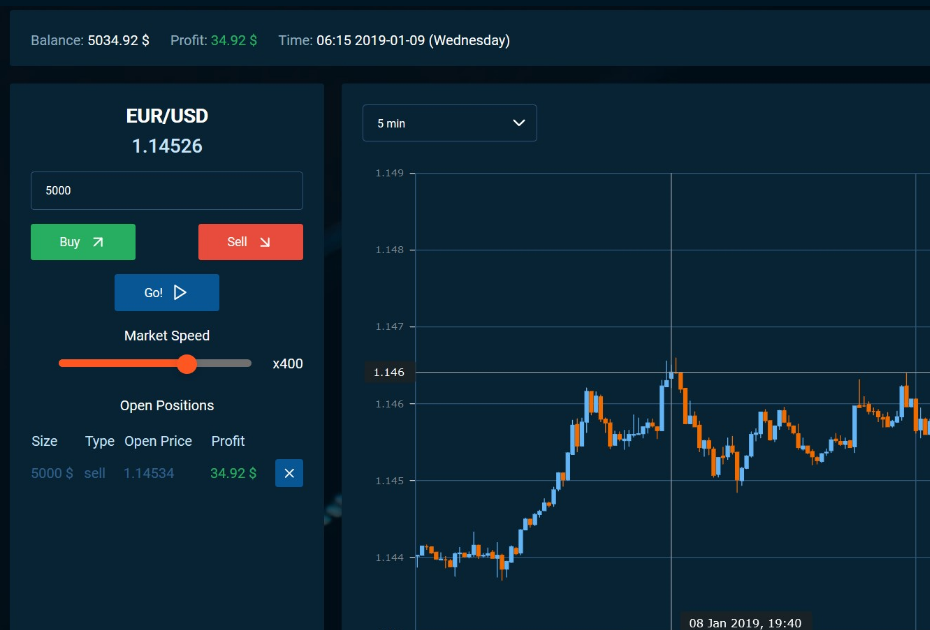

From the following article, you will find analyzed an educated CFD brokers and you may change platforms already available, taking into consideration secret provides for example earnings, segments, repayments and you can controls. Once you have started a good CFD change, try to frequently song field actions and you may to change your change positions correctly using the pc, online otherwise cellular programs available with your agent. Anticipate to behave swiftly whenever popular trade potential happen so you can ensure the quick entrance and you will exits away from CFD positions when your change plan determines a purchase will be made. CFD trade procedures are the foundation of a successful date individual, all the mind-declared forex and CFD millionaires can get tight ones it realize.

If you are control amplifies the profit potential if the places flow favourably, moreover it amplifies the chance visibility and you may possible loss. Dependent on your bank account type of, certain agents may charge payment on the trades otherwise give a larger bequeath as opposed to a commission. Make sure to look at the membership details understand any fees applied. Tighter spreads are often far more good for investors while they remove the price of trade admission and you will get off.

- As well as the bequeath, which is the cost of starting a swap, almost every other costs can get implement.

- The brand new bequeath is essentially the cost of trade CFDs and that is exactly how agents make money.

- And, be cautious out of too much volatility and you may consider utilizing defensive sales because the development incidents can result in quick field motion.

- Improve your exposure to certain asset brands to benefit of CFD agents.

- As opposed to old-fashioned exchange, CFD change doesn’t require taking control of your own underlying resource.

- One to significant advantage away from change CFDs ‘s the power to capitalize easily for the each other upward and downward moves inside a secured item’s market value.

- Instead of CFDs, US-based traders generally access economic locations because of a lot more controlled instruments for example because the choices, futures, otherwise change-replaced finance (ETFs), that are offered to the subscribed exchanges.

- If not, few trading might possibly be a method to change that have reduced chance, since the assistance of motion is not important.

- In case your trader thinks the new resource’s rates will increase, its basic change would be a purchase otherwise a lot of time status, the following trade (which closes the newest unlock position) try a great offer.

Areas.com prides alone inside giving tight advances and you may 0% commission in order to work at trade the manner in which you need to with no undetectable charge otherwise traps. Commodity CFDs ensure it is investors to take a position on the rate motions away from merchandise for example silver, oils, and you will grain. Product CFDs give traders exposure to the brand new product areas, without having to in person own the underlying advantage.

Secret concepts at the rear of CFD trading

When you’lso are willing to exchange CFDs, you’ll only have to choose your role size and implement their risk administration means. If your buyer thinks the fresh investment’s speed will increase, its basic trade was a buy or enough time condition, another exchange (and this closes the new discover status) try an excellent sell. On the other hand, if the trader thinks the fresh resource’s well worth have a tendency to decline, their starting trading might possibly be an excellent offer or small condition, the brand new closure trading a purchase. The new investor’s web profit ‘s the price difference between the hole and closing-aside trading (minus people fee otherwise focus). CFDs are a good ‘leveraged’ unit, meaning that buyers just need to put half the normal commission away from a full property value a trade to open up a posture.

CFDs render knowledgeable traders the capacity to bet on the price assistance out of assets, forecasting either a growth or fall to benefit of field volatility. Although not, making use of their advanced character and you can regulatory constraints, CFDs aren’t available for change in the us. You hedge to protect your investment returns or financing, especially in days of uncertainty. The idea is that if you to money goes against your, the hedge status goes into your own rather have. Such as, if you are searching for slow and you can constant growth, asset kinds having highest volatility is to setting an excellent proportionally small-part of your profile.

The importance maintained in the a great margin membership will act as security to have borrowing from the bank. Should your account security falls beneath the fix margin, Investment.com notifies you thru a ‘margin name’. That’s where you will either have to finest your equilibrium or intimate a few of your positions so you can lose your own publicity. However, again, would certainly be risking and then make a loss if the asset rates increase. A good CFD is an agreement between an agent and you will an investor who agree to replace the real difference inside value of a fundamental resource amongst the birth plus the stop of one’s offer, usually less than one day.

Investments are created to your speed direction from a secured asset, not on possessing the brand new advantage in itself. CFD exchange is founded on forecasting whether or not a valuable asset’s price often increase or slide. These types of tools obtain its worth from a main investment, such as a portion, item, currency, otherwise index.